Maximize Your Investments with Hard Money Georgia Financing Options

Maximize Your Investments with Hard Money Georgia Financing Options

Blog Article

Navigating the Process: What to Expect When Getting a Hard Money Financing

Getting a tough cash funding can be a nuanced procedure that requires a calculated approach to guarantee success. Understanding the vital steps-- from gathering crucial documents to navigating residential or commercial property valuations and loan authorizations-- can considerably impact your experience. Each stage offers unique considerations that demand interest to detail. As you prepare to engage with possible loan providers, it's necessary to realize what lies in advance and the aspects that might influence your application. A closer evaluation of these components exposes surprising understandings that might modify your approach to safeguarding funding.

Recognizing Hard Cash Fundings

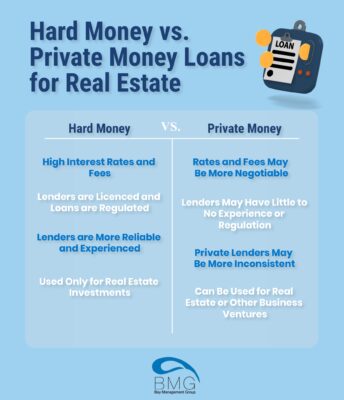

Hard money car loans represent a considerable choice to conventional funding techniques, specifically in property transactions. These lendings are usually safeguarded by the residential property itself rather than depending greatly on the consumer's credit reliability. Consequently, hard money lendings are often issued by personal lending institutions or investment teams, making them available to individuals or services that may deal with challenges acquiring standard financing.

Among the specifying features of hard money lendings is their expedited approval procedure. Unlike conventional financings, which may take weeks or perhaps months for underwriting and approval, hard cash fundings can commonly be protected within an issue of days. This speed can be specifically useful in competitive real estate markets, where time-sensitive chances occur.

Moreover, hard money car loans generally come with greater rate of interest rates and much shorter settlement terms compared to traditional fundings. Financiers regularly make use of tough money finances for fix-and-flip jobs or to promptly get properties before securing lasting funding.

Preparing Your Application

When requesting a tough cash car loan, it is necessary to thoroughly prepare your application to improve your opportunities of approval. Lenders in this area usually prioritize the asset's value over the debtor's credit reliability, however an efficient application can still make a substantial influence.

Begin by gathering all necessary documentation, such as proof of revenue, bank statements, and any type of relevant financial declarations. Although difficult cash lenders are much less concerned concerning credit score scores, offering a clear financial image can impart confidence in your application. In addition, include a thorough funding proposition outlining the function of the funds, the quantity asked for, and your payment plan

Consider supplying a recap of your real estate experience or past tasks, if suitable. This demonstrates your capability and increases lender count on. Make sure that your application is cost-free from mistakes and very easy to review, which shows your professionalism and reliability.

Property Valuation Refine

Generally, the residential or commercial property appraisal process for a tough money loan entails a thorough assessment of the collateral being used. This procedure is important, as the loan provider primarily depends on the value of the residential or commercial property to safeguard the finance. Unlike standard finances, where credit reliability plays a significant role, hard cash financings prioritize asset evaluation.

The evaluation typically consists of an extensive examination of the residential property by a qualified evaluator or actual estate expert. They examine various elements, such as area, problem, size, and similar sales in the area, to determine the reasonable market worth. In addition, the appraiser might assess any type of prospective issues that could influence the informative post residential property's worth, such as required fixings or zoning limitations.

It is crucial for borrowers to prepare their residential or commercial property for this assessment by guaranteeing it is complimentary and well-kept of significant problems. Providing any relevant paperwork, such as previous appraisals or renovation records, can also facilitate a smoother valuation procedure. Eventually, a successful evaluation can significantly influence the terms of the loan, consisting of the quantity accepted and the rates of interest, making it a pivotal action in securing a tough cash loan.

Funding Authorization Timeline

After finishing the residential property appraisal procedure, borrowers can anticipate the financing authorization timeline to unravel rapidly compared to traditional funding methods. Tough cash loans are generally characterized by their speedy approval processes, primarily as a result of the asset-based nature of the loaning model.

Once the valuation is complete, loan providers usually call for a couple of extra files, such as proof of revenue and recognition, to settle their evaluation. This documents process can typically be completed within a couple of days. Following this, the lender will evaluate the residential property's worth and the debtor's creditworthiness, though the last is much less emphasized than in conventional lendings.

Most of the times, borrowers can expect initial approval within 24 to 72 hours after submitting the required records. This try this site fast feedback is a considerable advantage for investors seeking to confiscate time-sensitive opportunities in realty.

Nevertheless, the last approval timeline may differ slightly based on the lending institution's workload and the complexity of the lending. Usually, customers can anticipate a full authorization process varying from one week to 10 days, enabling them to move promptly in their financial investment quests. Overall, the streamlined nature of difficult cash offering offers a distinctive side in the affordable realty market.

Closing the Car Loan

Closing the lending notes the last action in the difficult cash providing process, where both parties formalize the arrangement and transfer funds. This phase typically entails a collection of crucial jobs to make certain that all financial and legal commitments are fulfilled.

Before closing, the consumer should prepare for a final evaluation of the finance terms, including rates of interest, settlement timetables, and any kind of costs related to the finance. It is critical to resolve any kind of final questions or interest in the lender to prevent misconceptions.

During the closing conference, both events will sign the necessary paperwork, which may include the loan arrangement, promissory note, and safety and security agreement. The lender will likewise require evidence of insurance and any other conditions stated in the financing terms.

When all documents are authorized, the lending institution will certainly disburse the funds, typically with a cord transfer or check. This transfer may happen promptly or within a couple of service days, relying on the loan provider's policies. After shutting, the customer is officially in charge of settling the car loan according to the agreed-upon terms, marking a brand-new phase in their monetary journey.

Conclusion

In recap, browsing the process of getting a hard cash car loan calls for careful preparation and understanding of crucial components. Complete documentation, exact property assessment, and recognition of the expedited approval timeline are essential for an effective application. The final testimonial and closing process strengthen the arrangement and make sure compliance with loan provider requirements. A detailed understanding of these elements assists in a smoother experience and boosts the possibility of securing the preferred finance successfully.

Unlike conventional lendings, which might take weeks or also months for underwriting and authorization, tough cash car loans can typically be protected her response within an issue of days.In addition, difficult cash lendings generally come with greater passion rates and much shorter settlement terms contrasted to conventional loans.Normally, the home valuation process for a hard money car loan involves a comprehensive assessment of the collateral being provided. Unlike traditional loans, where credit reliability plays a significant role, tough cash financings focus on property assessment.

Ultimately, an effective appraisal can substantially affect the terms of the lending, including the quantity accepted and the interest price, making it a crucial step in securing a tough cash lending.

Report this page